By Gayle S. Putrich

STAFF REPORTER

Published: September 10, 2014 5:09 pm ET

Updated: September 10, 2014 5:19 pm ET

Image By: Jessica Jordan

The plastics industry's highest-paid executives.

The CEO of an automotive parts giant again tops the annual Plastics News list of highest-paid industry executives, and it’s the cash and stock bonuses tied to performance metrics that really set the top of the list apart.

Magna International Inc. again comes in first among plastics industry’s highest paid executives, with CEO Donald J. Walker bringing in $18.9 million in total compensation for 2013, according to our latest executive pay compensation ranking.

Walker is joined on the list of the 155 top-paid plastics execs by four fellow Magna executives: Executive Vice President and CFO Vincent Galifi at No. 7 with $7.6 million; Tommy J. Skudutis, chief operating officer for exteriors, interiors and seating, at No. 8 with $7.5 million; Jeffery O. Palmer, executive vice president and chief legal officer, at No. 14 with $5.5 million; and Guenther Apfalter, president of Magna

Europe and Magna Steyr, at No. 22 with $3.5 million.

Company size

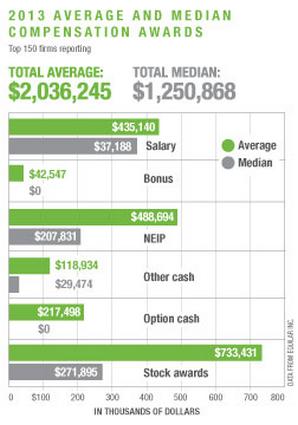

But Magna is an outlier in both executive compensation — especially considering the list’s total compensation median of $1,192,955 — and size. When it comes to pay, size does matter, explained Equilar Inc.’s Aaron Boyd, director of governance research.

“Size plays a big role,” Boyd said. “Magna pays their people a lot of money. So does Newell Rubbermaid, PolyOne — these are huge companies, they’re making a lot of money. Other, smaller companies can’t compete on size. Don’t underestimate size.”

Aurora, Ontario-based Magna is the largest automotive supplier in North America, with $34.8 billion in revenue and a $1.9 billion operating budget in 2013 and more than 130,000 employees at nearly 400 locations in 29 countries worldwide.

Newell Rubbermaid has two execs in the top five, including President and CEO Michael B. Polk at No. 3 and freshly-minted Executive Vice President and Chief Development Officer Mark S. Tarchetti at No. 5. The Sandy Springs, Ga.-based consumer products giant boasts more than 19,000 employees and reported sales of approximately $5.7 billion in 2013.

“For executives, especially a CEO, their job is always on the line, and the company’s revenue is only a part of the equation in figuring out if they’re doing a ‘good’ job,” Boyd said. But the bigger the company, the bigger the risk a CEO is taking with every decision they make, Boyd said, and that plays a big role in the crafting of executive compensation packages.

PolyOne Corp.’s newly retired chairman, president and CEO, Steve Newlin, is second on the list, and propelled the Ohio-based specialty compounder to a record annual revenue of $3.8 billion in 2013. The lion’s share of his $11.3 million pay package — nearly $8.5 million of it — came in the form of performance-based cash and stock awards.

“One of the trends in recent years has been to move away from cash and more towards equity,” Boyd said. “To align pay with performance to a greater degree, companies are looking for a way to tie that better to equity.”

It’s not necessarily a brand new trend and it isn’t that, with reporting changes at the U.S. Securities and Exchange Commission reporting rules, all of a

sudden companies tied pay and performance. But it is a more visible trend now, particularly with the amount of disclosure “increasing 100 fold since 2006,” Boyd said.

“Now investors and the general public can look at how companies expect to perform and set goals and that transparency has changed how companies go about doing it,” he said. “Metrics, goals, everything is much more transparent and in the open.”

And with the goals more visible to the public, and shareholders, publicly traded companies are also finding themselves revealing more and more of the overall goal-setting process, including when the goals are tied to executive pay.

Image By: Jessica Jordan

Coming out of the recession that began in 2008, “there was a lot of negativity around setting too-aggressive goals,” Boyd said. “No one was sure what the market was going to do, so everyone played it a little more conservatively. As we’ve reached a more stable period, there is less concern about dramatic market drop. When there is a better sense of where the market is going, [corporate boards] become more aggressive about setting those goals, thus making it harder for the executive to meet those goals and get those payouts.”

Culture and company history also has a lot to do with how pay metrics are built.

“Each company has their own culture and the pay plan could reflect that culture and those values, not just the goals,” Boyd said.

Magna’s top executives receive the identical base salary of $325,000 per year. The other $18.6 million in CEO Walker’s paycheck? All various permutations of performance-based payouts. And those could grow even larger by the time the next Plastics News executive pay ranking rolls around: in a recent interview with Bloomberg News, Walker said he is much more willing to take on debt or issue equity to finance transformative acquisitions, a big move away from the debt-averse strategies of founder Frank Stronach, who stepped down from the chairman position in 2011.

The move toward equity rewards for performance also accounts for a negative percent change in cash pay over the previous year. Of those surveyed, 64 of 155, or 41 percent, reported a drop in the cash portion of their 2013 annual income over the previous year. But with an increase in stock and option awards, for some the shift actually meant an overall pay increase.

Even taking into account outliers and industry giants, plastics industry executive compensation seems to be keeping pace with other industries and national trends.

“Just looking at the numbers overall, this is pretty consistent with what we’ve seen in the broader marketplace with regards to the pay trends,” Boyd said.

Executive pay is going up, he said, driven by the value of the company’s equity, tied to stocks and options.

Plastics News’ executive ranking covers only executives from North American companies that publicly traded equity or debt for the 2013 calendar or fiscal years and that generate roughly 50 percent or more of their annual revenues from the in-house processing, recycling or compounding of plastics. The ranking data was supplied by Redwood City, Calif.-based Equilar Inc., an executive compensation research firm.

Ins and outs

Sometimes getting out of the business is the best way for a top exec of a publicly traded company to get paid. Several outgoing executives saw their ranking boosted a bit by cash bonuses on their way out the door, ranging from $1 million for former Hexcel Corp. Chairman and CEO David E. Berges (12) to $30,000 for Joe G. Brooks (153), Advanced Environmental Recycling Technologies Inc. founder and outgoing chairman. It’s a discretionary benefit that Equilar’s Boyd says has largely gone by the wayside in recent years.

Joining a new company is sometimes more lucrative than leaving it, but it might not be money a top executive sees right away in the current pay-for-performance and equity-driven bonus climate. Rather than a cash bonus as an incentive to sign on, incoming executives these days are more likely to be wooed with equity awards.

Among the new plastics executives, Rubbermaid’s Tarchetti, a former head of global corporate strategy and 14-year Unilever veteran, joined the company in January 2013 after consulting for Newell Rubbermaid via his international consulting firm, Tarchetti & Co. Ltd., and was welcomed with a more than $6.5 million stock award, the second-highest such award on the list (behind Rubbermaid CEO Polk at about $7.2 million in stocks for 2013). Jerome A. Peribere has been Sealed Air’s CEO since March 2013, and its president since August 2012, after leaving Dow Chemical Co.; his first-year equity take was about $6.2 million, putting the new packaging executive fourth in stock awards as well as fourth in the ranking overall. And Robert F. Mehmel got $3.2 million in stock for making the move from defense technology company DRS to president and COO of holding company Griffon Corp. last year, the eighth-highest equity award.

Executive equity awards don’t pay out over multiple years, Boyd explained, partially acting as incentive to stay with a company, since the executives have to be concerned about increasing stock value over multiple years to get the full value of their equity compensation.

“New people tend to get that stock bonus for retention and encouragement,” Equilar’s Boyd said. “It gets them invested in the company and the new position. It’s a definite look into the future for some of them.” |